Tulsa Housing Study highlights housing crisis, investment needs

An independent study of Tulsa’s housing crisis reveals a $2.45 billion gap that requires an estimated $245 million per year for 10 years from private, public and philanthropic investments to close.

Tulsa Housing Study

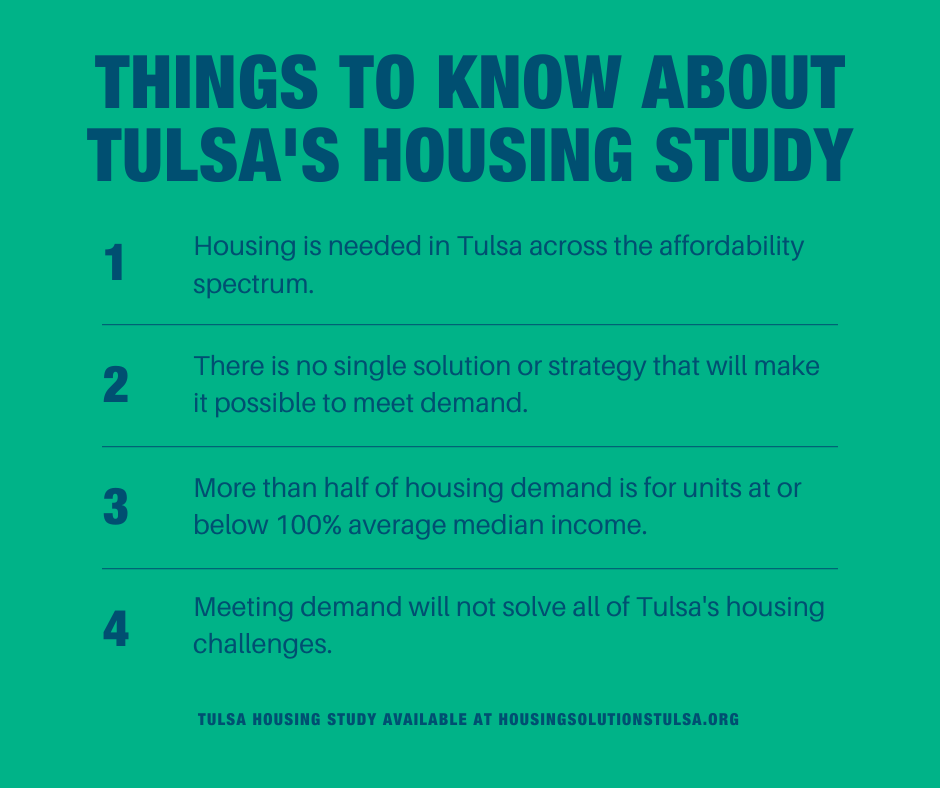

The study is the first of its kind for Tulsa and provides data for leaders to make informed decisions and potential strategies to close the gap.

The study was paid for by The Anne and Henry Zarrow Foundation; facilitated by Housing Solutions; conducted by Development Strategies and Homebase; and supported by the City of Tulsa, Partner Tulsa, Downtown Tulsa Partnership and Tulsa Housing Authority.

Where could the funding come from?

The housing study estimates that about 85% of the needed $245 million annual investment can be made through conventional financing sources paired with gap-financing tools and existing public-sector programs. The remaining 15%, or $37 million, will require innovation and collaboration across the community

How should resources be spent?

The study breaks down Tulsa’s needs into seven areas that completely cover the city. All seven areas need substantial portions of the estimated $245 million per year. Overall, the study recommends about 20%, or $50 million per year, be spent on rehabilitation to support Tulsa’s existing housing market. 80%, or $195 million per year, should be spent on new construction.

Demand broken down by affordability

Income level by Tulsa’s average median income (AMI) | Total 10-Year Demand | Methods to Support Preservation and Development |

Extremely Low Income (<30% AMI or <$20,000) | 2,160 units |

|

Very Low Income (30% AMI to 50% AMI or $20,000 to $30,000) | 1,790 units |

|

Low Income (50% AMI to 80% AMI or $33,000 to $54,000) | 2,300 units |

|

Moderate Income (80% AMI to 120% AMI $54,000 to $81,000) | 2,290 units |

|

High Income (>120% AMI or >$81,000) | 4,360 units |

|

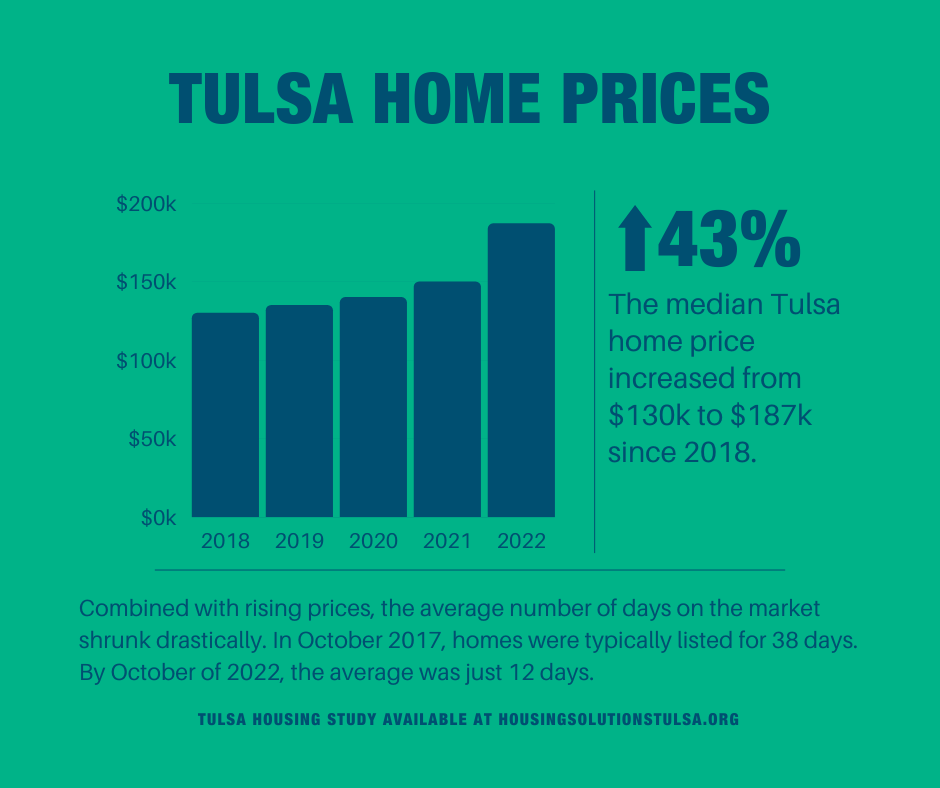

Sources: Tulsa Housing Study, Zillow.com and The Atlantic.